boulder co sales tax return

Did South Dakota v. Filing frequency is determined by the amount of sales tax collected monthly.

Construction Use Tax City Of Boulder

Para asistencia en español favor de mandarnos un email a.

. Credit may be taken against Boulder use tax for legally imposed sales or use taxes paid to other municipalities. If you need additional assistance please call 303-441-3050 or e-mail us at. State of Colorado Boulder County and RTD taxes are remitted to the State of Colorado via the Colorado Department of Revenue.

Such credit may not exceed the Boulder use tax due. There is a one-time processing fee of 25 which may be paid by cash or check. Longmont Sales Tax Division 350 Kimbark St Longmont CO 80501.

GROSS SALES SERVICES. The citys Sales Use Tax team manages business licensing sales tax use and other tax filings construction use tax reconciliation returns and various tax auditing functions. A Boulder Colorado Sales Tax Permit can only be obtained through an authorized government agency.

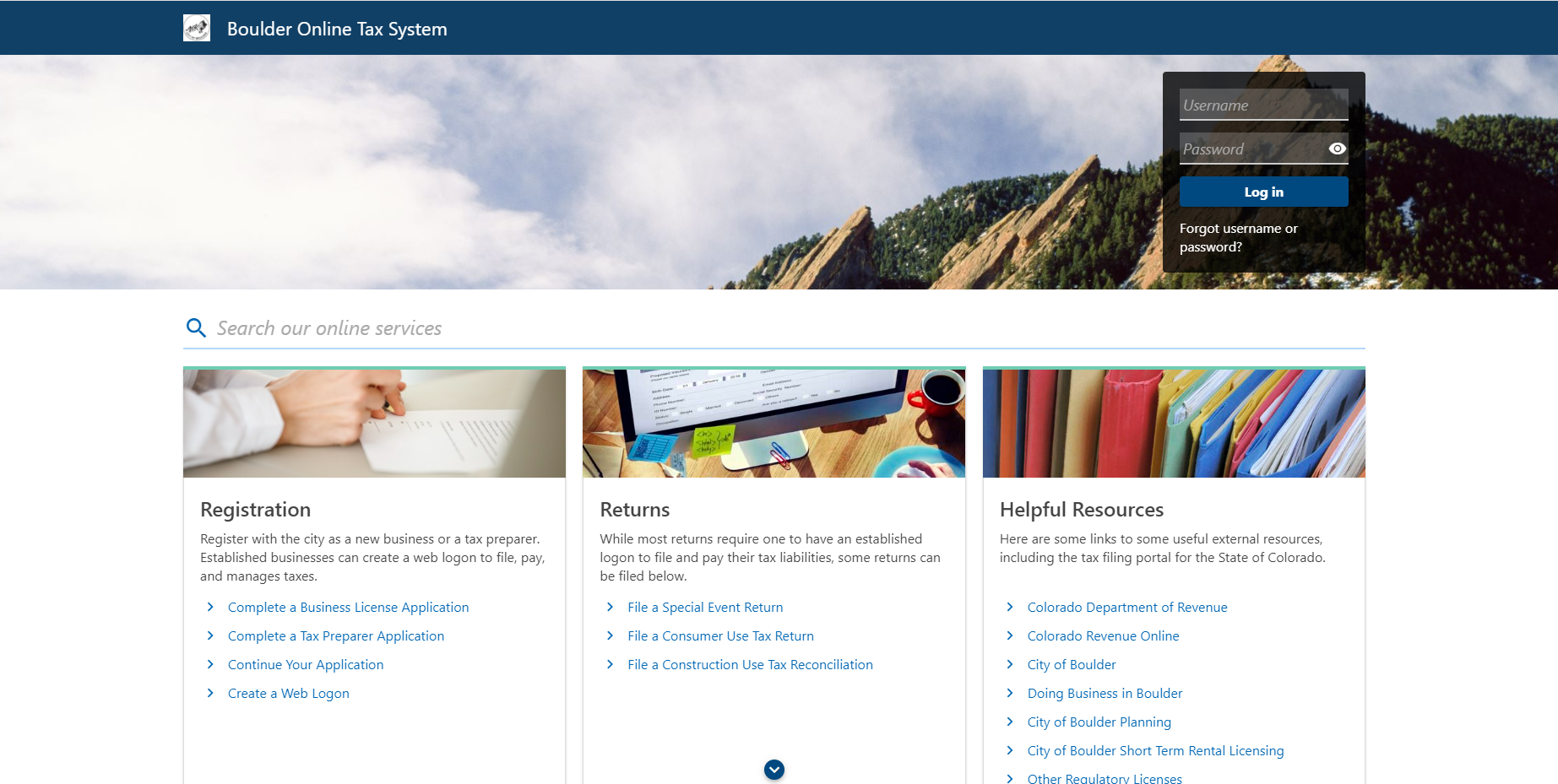

Sales tax licenses are required from both the city and state for businesses to operate in the City of Boulder. Salestaxbouldercoloradogov o llamarnos a 303-441-4425. Navigating the Boulder Online Tax System.

The Colorado Department of Revenue administers not only state sales tax but also the sales taxes imposed by a number of cities counties and special districts in Colorado. The total sales tax rate in any given location can be broken down into state county city and special district rates. Return the completed form in person 8-5 M-F or by mail.

This is the total of state county and city sales tax rates. For tax rates in other cities see Colorado sales taxes by city and county. Boulder County does not issue licenses for sales tax as it is collected by the.

Important Message Line 5 plus line 6 8. DR 0235 - Request for Vending Machine Decals. The City of Lovelands sales tax rate is 30 combined with Larimer Counties 080 sales tax rate and the State of Colorados 29 sales tax rate the overall total is 670.

For information related to specific tax issues for state county or RTD please contact the State Department. 2055 lower than the maximum sales tax in CO. Sub-Total of Sales Taxes.

Balance due from Lodging Tax Return Attach copy of return 1. Any retail sale that is made in Boulder County is subject to county taxaon. The Colorado sales tax rate is currently.

Sales Tax Accounts Licenses. Contact those cities directly for further information. Boulder Online Tax System.

The Boulder Sales Tax is collected by the merchant on all qualifying sales. Wayfair Inc affect Colorado. With local taxes the total sales tax rate is between 2900 and 11200.

Sales tax returns may be filed annually. DR 0155 - Sales Tax Return for Unpaid Tax from the Sale of a Business. Yes any person that owns construction equipment with a purchase price of 2500 or more and brings it into the City of Boulder for use or storage is required to file a Construction Equipment Declaration to determine the use tax that may be owed to the City.

If you have more than one business location you must file a separate return in Revenue Online for each location. DR 0100 - Retail Sales Tax Return Supplemental Instructions DR 0103 - State Service Fee Worksheet. The city use tax rate is the same as the sales tax rate.

Filing Frequency Due Dates. The Boulder Colorado sales tax is 885 consisting of 290 Colorado state sales tax and 595 Boulder local sales taxesThe local sales tax consists of a 099 county sales tax a 386 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc. DR 0154 - Sales Tax Return for Occasional Sales.

15 or less per month. The County sales tax rate is. Access and find resources about the Boulder Online Tax System below including how-to videos and PDF guides.

Colorado has a 29 sales tax and Boulder County collects an additional 0985 so the minimum sales tax rate in Boulder County is 3885 not including any city or special district taxes. For additionalon informatiregarding use taxefero tthe r Boulder Revised Code 3-2-1b. However the Department does not administer and collect sales taxes imposed by certain home-rule cities that instead administer their own sales taxes.

Colorado Department of Revenue Sales Tax Division 303-238-7378 Boulder County Office of Financial Management Sales Use Tax 303-441-4519 Sales Tax Boulder Countys Sales Tax Rate is 0985 for 2020. BOULDER COUNTY SALES TAX TAX DISTRICT RATES Boulder County collects sales tax at the rate of 0985 on all retail transacons in addion to any applicable city and state taxes. This is the total of state county and city sales tax rates.

The Boulder sales tax rate is. File Sales Tax Online. Line 7 times 3 Max 200 Enter -0- on Late Return 9.

The minimum combined 2022 sales tax rate for Boulder Colorado is. Boulder County 0985 TOTAL Combined Sales Tax Rate in Longmont. Line 7 minus line 8 10.

Use tax must be paid by City of Boulder businesses and individuals for purchases brought into City Limits that did not include City of Boulder sales tax or when inventory acquired at wholesale is used by the business instead of being sold to customers. This table shows the total sales tax rates for all cities and towns in. Colorado has recent rate changes Fri Jan 01 2021.

About City of Boulders Sales and Use Tax. Colorados state sales tax is 9 and its 0 percent. For assistance please contact the Sales Tax Office at 303-651-8672 or email SalesTaxLongmontColoradogov.

The Colorado state sales tax rate is. MTS sales tax is remitted in the countyMTS column on the DR 0100 Retail Sales Tax Return MTS Boundaries Sales Tax Rate Service Fee Allowed Exemptions Use Tax Rate Use Tax Applies Eagle County Eagle County limits 05 3 13 A B C K None Pitkin County Pitkin County limits 05 0 05 Motor Vehicles Building Materials. Vendor FeeNet Broomfield City and County Sales Tax.

Businesses located in the Centerra Fee districts sales tax rate is 175 and is in addition to the district fees. Sales tax is due on all retail transactions in addition to any applicable city and state taxes. The 8845 sales tax rate in Boulder consists of 29 Colorado state sales tax 0985 Boulder County sales tax 386 Boulder tax and 11 Special tax.

After you create your own User ID and Password for the income tax account you may file a return through Revenue Online. Colorado CO Sales Tax Rates by City A The state sales tax rate in Colorado is 2900. This is the total of state county and city sales tax rates.

DR 0594 - Renewal Application for Sales Tax License. Information about City of Boulder Sales and Use Tax. Some Colorado home-rule cities that collect their own local sales tax charge a sales tax on certain services.

The combined sales tax rate for Boulder CO is 8845. You can print a 8845 sales tax table here. How to Apply for a Sales and Use Tax License.

Refer to Boulder Revised Code BRC 1981 section 3-2-2 a 9- 14 and Tax Regulations. There are a few ways to e-file sales tax returns. Purpose of Form The Initial Use Tax Return is required to be filed by any.

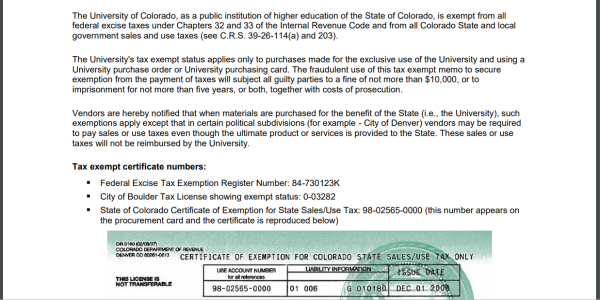

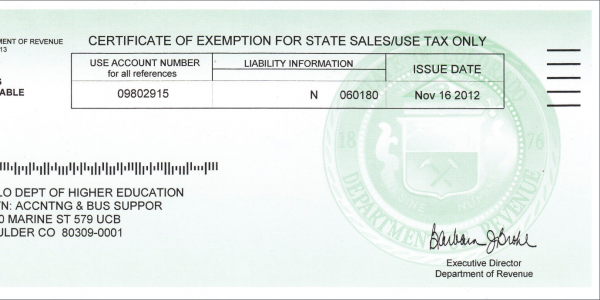

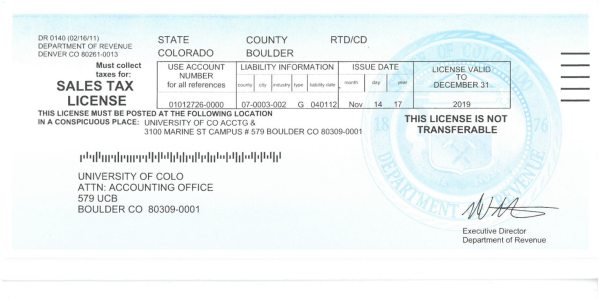

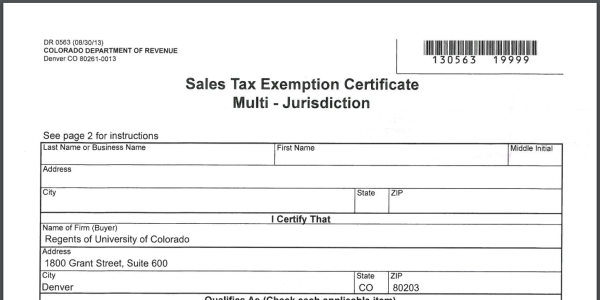

Sales Tax Campus Controller S Office University Of Colorado Boulder

Getting Your Business Established In Boulder Colorado

Sales Tax Campus Controller S Office University Of Colorado Boulder

Short Term Dwelling And Vacation Rental Licensing Boulder County

Boulder Skyline Art Print Boulder Decor Colorado Flatirons Etsy

Boulder Colorado Co Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Sales Tax Campus Controller S Office University Of Colorado Boulder

Sales Tax Campus Controller S Office University Of Colorado Boulder

Sales Tax Campus Controller S Office University Of Colorado Boulder

Albedo Effect Science Climate Change Problems Albedo

Sales And Use Tax City Of Boulder

How Cu Boulder Is Funded Budget Fiscal Planning University Of Colorado Boulder

City Of Boulder Colorado Sales Use Tax Return Form Download Fillable Pdf Templateroller